Did You Know?

About The National Electricity Market (NEM)

The NEM commenced operation as a deregulated wholesale market following government reform. It supplies electricity to retailers and end-users in QLD, NSW (including the ACT), VIC, and SA since December 1998. TAS eventually joined the NEM in 2005 via the undersea Basslink DC link into VIC with NEM operations currently encompassing five interconnected regions with individual wholesale prices largely following state boundaries. The NEM is one of the world’s longest inter-connected systems covering approximately 40,000 km. The links below show how the interconnected system looks today.

These regions operate in correlation and co-dependence of each other driven by demand circumstances. The maps below are a simplified historical comparison of the NEM system map (link above & below) highlighting the capacities of the major regional interconnections:

Energy flows directionally and volumetrically between states largely as a result of state-based demand driven by local temperature and generator behavior;

Historical maximum demands and installed capacities from 1999 until today for the entire system and the individual states.

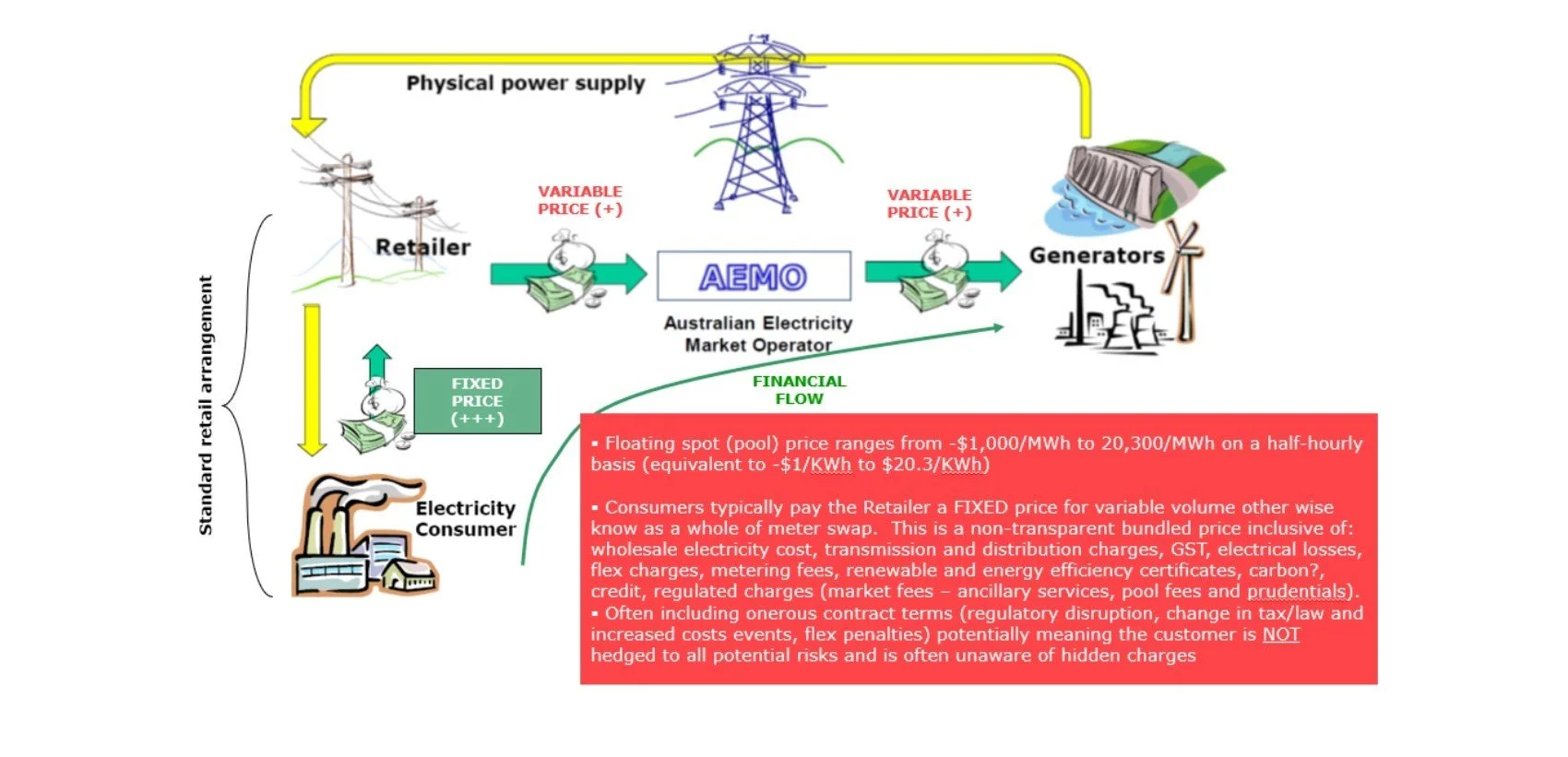

The market has a single market operator called AEMO overseeing the management of the NEM with the primary goal of reliability and security of its operation in terms of real-time supply on demand on a 24-hour basis. Wholesale trading in the electricity market is conducted via the spot market (gross pool) where supply and demand instantaneously match in real time through a centrally coordinated dispatch. Generators offer to supply the market with specific amounts of electricity at generator-specified price bands. Offers to generate are submitted every five minutes of every day of every year. From all offers submitted, AEMO determines the generators required to produce electricity based on the principle of meeting real-time demand in the most cost-effective way including sourcing the cheapest available energy from the lowest-cost region. The major interconnectors and spot price node locations are shown in the links above.

AEMO dispatches these generators into production via their bid stacks adding to a collective state-wide and neighboring region bid stack. A dispatch price is intersected every 5 minutes to finalise the spot price for the trading interval for each region of the NEM. AEMO and all market participants use the spot price as the basis for the settlement of financial transactions for all energy produced in the NEM. The legislated National Electricity Rules have a maximum spot price, also known as the Market Price Cap, of $20,300 per megawatt-hour (MWh). This is the maximum price at which generators can bid into the market and is the price automatically triggered when AEMO directs network service providers to interrupt customer supply to ensure supply and demand in the system in balance. This price is capped at 7.5 hours for a 7-day rolling period, after which the spot price becomes administered, capped at $600 MWh until all of the extreme prices have rolled out of this period.

Below [SUPPLY] Generators are stacked from the cheapest to the most expensive. As [DEMAND] goes up, this calls for more generation (on a more expensive basis) and it’s the last generator to be called to equalise demand and supply that sets the price for the state and possibly the whole system.

We can monitor the supply side with good accuracy in real-time, but demand is influenced by day-to-day weather which we need to be analytical about to optimise a customer-specific load in relation to the overall system demand.

Example: in summer people start turning on air conditioners creating record demand levels;

Hot weather = High demands = High prices and Mild temperatures = Low demands = Low prices;

A good understanding of weather influences and how generators bid into the market will give you the edge in forecasting electricity prices.

Follow Us >>